I doubt it’d fix the housing crisis here, but it would certainly help. I’m not sure how many people would warm up to it, though. A large part of our problem is that there isn’t any affordable housing. The fact the average house cost in 2023 was around $450,000 is insane, especially given the median income in the US was roughly $75,000 in 2022.

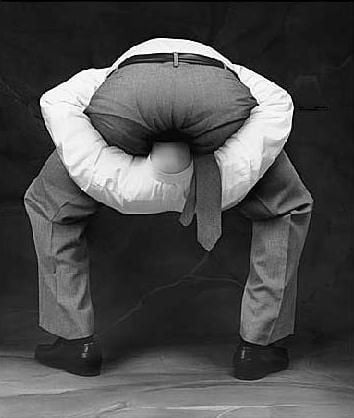

So yes, being able to buy back our mortgage’s bonds at their market value may be a boon, but the fact that the Dane’s require at least 20% down for their system to work would be a nonstarter for so many people. Roughly 65% of Americans are living paycheck to paycheck. A small minority of people are going to have the ~$80,000 to required to put down on a $450,000 house. Ultimately, turning housing into such a profitable investment option has led us to this situation, as having fewer houses means the existing houses are worth more and will only increase in value, making it a much more attractive investment than building new housing en masse.

The point of requiring 20% is to suppress demand, pushing prices down toward affordability.

spoiler

asdfasfasfasfas

I’ve been found out! I didn’t read the article 😂

spoiler

asdfasfasfasfas

spoiler

asdfasfasfasfas

The nice thing about owning a home is that you actually build up your saving. If you at some point get in hot waters you can sell your home to get some backup cash.

spoiler

asdfasfasfasfas

as a renter you aren’t responsible for upkeep/changes to the home

Nobody likes big unexpected costs. That’s why landlords tend to offload the risk to PMCs, warranties, and insurance.

And then your rent pays for the monthly costs of all of that.

spoiler

asdfasfasfasfas

That would be true of landlords didn’t also know that and, in turn, redline rent to the maximum tenants can possibly pay.

I don’t know about the US specifically, but In Canada, investors big and small have bought up all the rental stock and rents are now maxed out beyond what many people can pay.

spoiler

asdfasfasfasfas

As a boomer, one of the biggest “flaws” I see in this irl, is that people won’t sell their shit, and their dreams die in their sleep, with them.

Yea, that’s true. But I would say that is still better then forking over money into the rent furnace each month right?

spoiler

asdfasfasfasfas

It must be different in different places. I went from a renter in one area, to an owner in the same area, to a renter again in a different area in the period of 5ish years (long story).

Rent in the first area was about the same cost for a two bedroom, two bath, 1000 sq ft apartment as the entire mortgage on a 3 bedroom, 2 bath, 1200 sq ft house, including principle, interest, and taxes. The only reason people would rent there is because they don’t have the money for a down payment.

When we left that area, we could have become landlords and rented the house out. We could have easily gotten twice the entire mortgage in rental income, but we felt that being a landlord was unethical (especially since we were relatively wealthy for that area, although we made less than the US median family income). We sold the house and broke even.

Now, we live in a much higher COL area. It’s true here that renting is much cheaper than buying, but that’s because you can’t get a SFH for less than about $1.5 million here. My rent on my 1 bed, 1 bath, 700 sq ft apartment is more than twice my mortgage in my previous area. Our incomes have increased, now we make slightly above the median family income. But our leftover at the end of the month honestly went down a ton. If we weren’t here to get an education, we’d be gone by now.

Just saying… As someone who has both rented and owned, I definitely feel more like I’m shoveling money into a fire as a renter. Owning was the best financial situation I’d ever been in.

spoiler

asdfasfasfasfas

Maybe, but that doesn’t really have anything to do with what the article is covering.

spoiler

asdfasfasfasfas

We don’t have enough homes we are millions of homes short. There is no solution until building goes into over drive.

The number of empty houses in North America is absurd. Zoning and regulatory structure are as much an issue as construction.

This sounds good, but I don’t fully grasp the covered loan aspect. So the bank is required to sell a matching bond on the open market. What’s the difference between the rate on mortgage and the rate on the on bond? Is it also matched or just the principal? Does that make the interest a wash for the bank, so that their primary motivator is fee collection?

Here’s an in-depth comparison between the US and Danish mortgage models. It’s a PDF from the NY Fed: